Sustainable capital allocation without compromise

Sustainability

Sustainable investing

In 1987, ‘sustainable development’ was defined by the United Nations as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” A widely recognisable definition and still taught in classrooms today as the theoretical foundation upon which sustainable investing is built.

We define sustainable investing as a holistic approach to investing which widens the focus of investors by integrating sustainability considerations alongside the traditional focus of investors, risk-adjusted return. It comes in many shapes and sizes but can be distilled into three primary pillars: environmental, social, governance (ESG), impact, and ethics.

ESG

ESG is the integration of material non-financial data into the risk management process; the reason being, integrating more material data can improve the process and so can improve risk-adjusted returns. Examples of non-financial data include:

Greenhouse gas (GHG) emissions

Employee diversity

Financial reporting quality

The outcome of this integration might be to prioritise or reduce exposure to certain geographies or sectors or companies.

Impact

Impact is an explicit statement of sustainability targets separate to risk-adjusted return. Examples of these targets include:

Reducing GHG emissions in-line with the Paris Agreement

Improving gender and racial diversity at the board, management or workforce level

Ethics

Ethics, or ethical investing, is the integration of an investor’s moral or religious beliefs into the portfolio construction process. It is the oldest of the three pillars of sustainable investing and can trace its roots back hundreds of years to Shariah, the religious law of Islam, and to religious groups that prohibited members from participating in the slave trade. A more modern interpretation might be to exclude tobacco or firearms from an investable universe.

Our approach

Titan Asset Management are a proud signatory to the UN Principles for Responsible Investment , a partner of the Global Returns Project and a Gold sponsor of the London School of Economics Green Finance Society.

Our sustainable investment proposition has been curated for longevity, and we believe that small steps towards positive change are possible by finding a sustainable way of allocating capital. Our partnerships add unprecedented value. Titan Asset Management’s sustainable investment policy leverages several market-leading data providers, ensuring that our approach to sustainable investing is truly holistic, broad, intersectional, integrated and risk-adjusted.

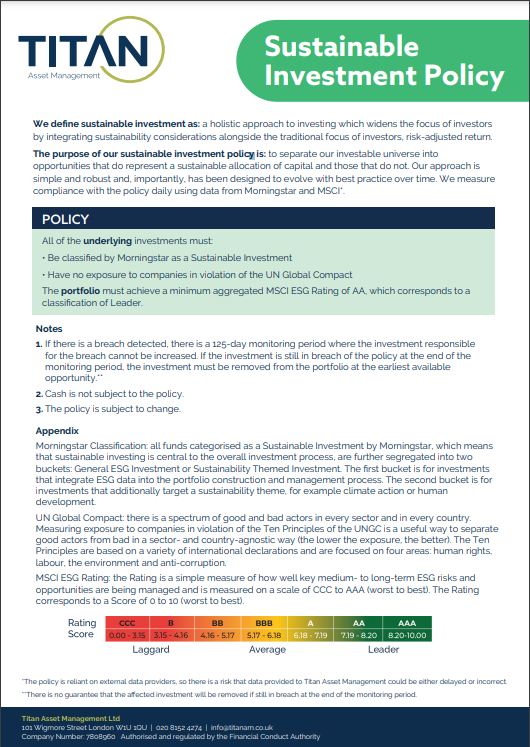

The purpose of our policy is simple. We separate our investable universe opportunities into two categories: those which represent a sustainable allocation of capital, and those which do not. This approach means that, across our sustainable investment proposition, we have exposure to all three of the pillars that constitute sustainable investing.

There are three sections to our policy:

First, all investments must be classified by Morningstar as a sustainable investment

Second, there must be no exposure to investments with any exposure to companies in violation of the UN Global Compact (UNGC)

Finally, the portfolio of investments must achieve a minimum aggregated MSCI ESG Rating of AA, which corresponds to a classification of Leader.

There are procedures in place to ensure daily compliance with the policy and protocols to follow if a breach to the policy is detected. These procedures and protocols have been put in place to mitigate the industry-wide challenge of greenwashing. Our focus on non-financial data-driven risk management is powerful in its simplicity and, importantly, relevant processes will continue to evolve to match best practice in the sustainable investing ecosystem.

We rely on various third-party data providers, including Morningstar (Sustainalytics), MSCI and Util to assist us in our approach to sustainable investing.

There are six risk-progressive models (3-8) available in the Titan Sustainable MPS, and Titan Asset Management donate a portion of our management fee (5 bps) from the Titan Sustainable MPS to the Global Returns Project’s Portfolio. See our bespoke MPS range here.

Downloads

Sustainable investment policy

Sustainable investment report Q2 2023

Our sustainability partners

UN Principles for Responsible Investment

Titan Asset Management became a signatory to the United Nations’ Principles for Responsible Investment (PRI) in 2022. The PRI is the world’s leading proponent of responsible investment. It works to understand the investment implications of ESG factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions. The PRI acts in the long-term interests of its signatories, of the financial markets and economies in which they operate, and ultimately of the environment and society.

To find out more about the PRI and the principles, click here.

London School of Economics, Green Finance Society

Titan Asset Management became a sponsor of the London School of Economics (LSE) Green Finance Society (GFS) in 2020. The GFS is the sole sustainable finance-focused society at LSE. Their mission is to encourage greater consideration of environmental risks in financial decision-making and to equip LSE students with the skills and background knowledge required in this field. Over the past few years, we have thoroughly enjoyed working with the Society on a series of exclusive events, as well as participating in the flagship Sustainable Finance Conference. We continue to be impressed by the students’ enthusiasm for and understanding of topics within sustainable finance.

If you could make government bond strategies more sustainable, how would you do it, and where would you start?

As part of our ongoing partnership with the Green Finance Society, the LSE students collaborated with our sustainability lead, James Peel, on the society’s final project of the 2023/24 academic year. In ‘Evergreen’, a research paper, the students explored the various challenges of integrating sustainability considerations into government bond strategies. Then, the teams reviewed a selection of literature from academia and practitioners on the subject, and used their findings to design a government bond methodology that effectively integrates sustainability considerations.

To read the report, click here.

To find out more about the GFS, click here.

Util

ESG ratings, like those built by MSCI, help us to better understand how well ESG risks and opportunities are being managed by companies. It is also possible to measure whether the actions of companies are generating any positive or negative outcomes in the real world. The UN Sustainable Development Goals (SDGs) provide the common language for investors like Titan Asset Management to evaluate these real-world outcomes. Util uses natural language processing, a type of AI, to assess how companies affect the SDGs, which can be further broken down into thousands of other sustainability concepts. We analyse our sustainable investment proposition through the Util lens, reporting on our findings in regular client communications.

To find out more about Util and what they do, click here.

Global Returns Project

Capital allocation will play a meaningful role in the transition to a more sustainability-minded planet. Measuring the impact of our capital allocation, as we do by using Util’s dataset, is an important first step for us in this transition. But we can go further. Titan Asset Management became a partner of the GRP in 2022. GRP is a UK registered charity (no. 1186683) which curates the ‘Global Returns Portfolio’: a selection of diverse and effective not-for-profits tackling the twin biodiversity and climate crises. We have integrated a donation to GRP into our fee structure for some bits of our proposition. The purpose of doing so is to resolve the disconnect between allocated capital and real-world impact.

To find out more about the GRP, click here.